Music hello, this is Matthew Hill for the Hill and Ponton video blog. I'm here with Carol Ponton, and we're doing a series on the big mistakes that veterans make, which we see repeatedly, that end up hurting their claims. Today, we want to talk to you about unemployability. There is always a question about when to file for unemployability. Just to clarify, unemployability is a way to get a 100% rating when your combined ratings do not add up to 200%. It is a way for the VA to recognize that you cannot work due to your VA disabilities. With unemployability, you would receive the same benefits as if you had a 100% rating if your combined ratings add up to 100%. It is a very important benefit. However, what we find is that people often do not file for unemployability. For example, if a veteran is trying to get a higher rating for PTSD and they cannot work due to PTSD, they should file for unemployability as soon as they start filing for the PTSD. To file for unemployability, you need to fill out a form called the 8940. This form shows where you last worked and that you are currently not working due to your service-connected problem. If you have not yet been service-connected for PTSD, the VA will deny your unemployability claim. However, once you win your case for PTSD, the unemployability claim will be reconsidered. Many people make the mistake of waiting until they have been service-connected before filing for unemployability. This restarts the process and puts the claim at the back of the line. What Carol is saying is that if your back problem is not service-connected yet but is keeping you out of work, you should still file for unemployability. Some people may question why you are...

Award-winning PDF software

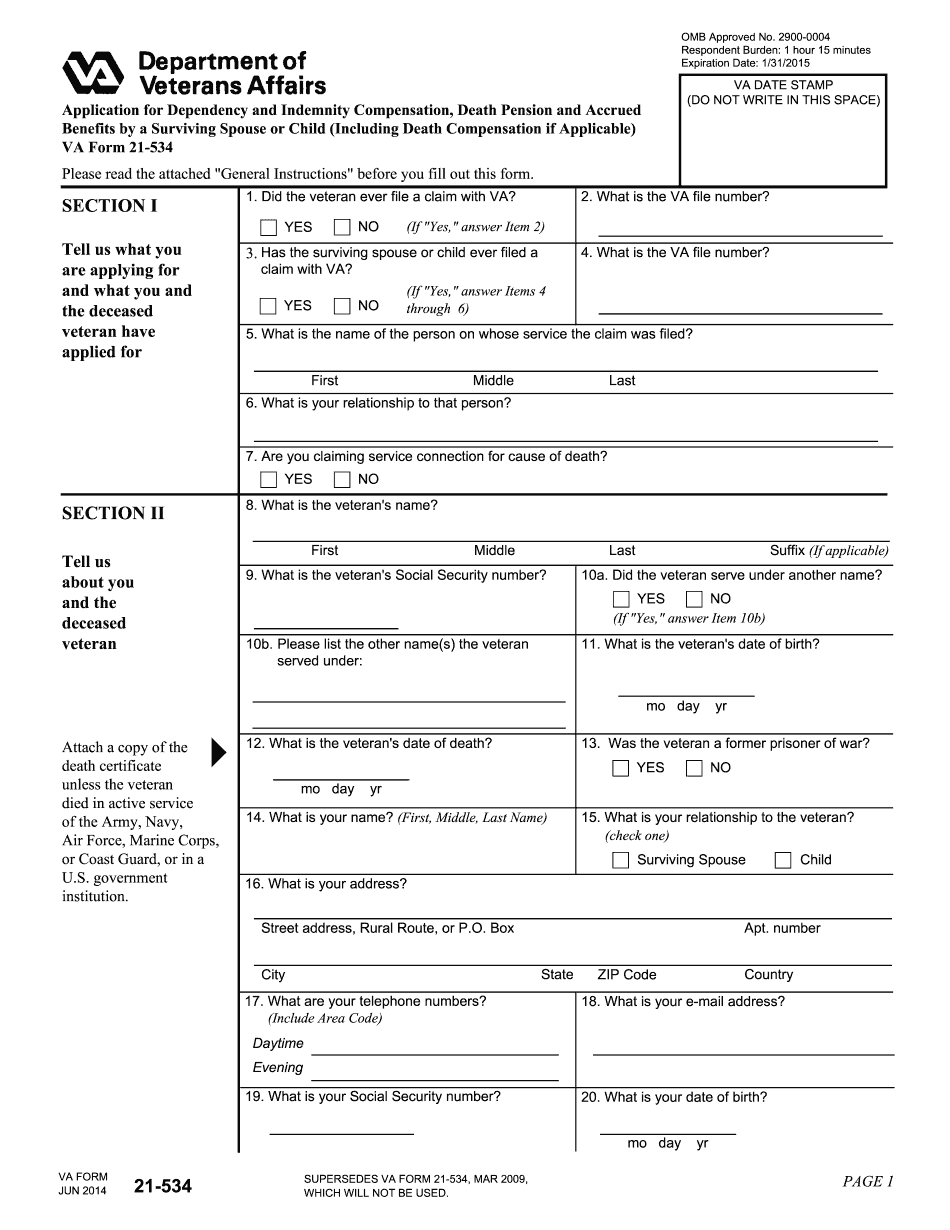

Va 21-534 Form: What You Should Know

It's easy to fill out and use. For example, what it will tell the veteran, spouse or parent is: Do you qualify for VA benefits as the surviving spouse or child? Are the survivor's dependent children currently enrolled in school For example, if the Veteran is married, and has two adult children who are not enrolled in school, the form will inform the Veteran that the child's education cannot continue. The form tells a survivor the following: The child(men) can continue in their education if the parent(s) who is listed under Dependent on the VA Form 21-534 can no longer provide a secure financial safety net to support the child(men) If the surviving spouse's or child(men)'s dependent parents are in the military's education system, they will have to cover the cost of the child's education (up to the amount the dependent must pay). If a surviving spouse or child has any dependents outside the military service, the dependents' educational benefits must be paid by the child. Here's what the form would look like when completed: VA Form 21-534.pdf — Air Force Wounded Warrior and Veterans' Program — Wounded Warrior Program Benefits for Disabled Service members by VA FORM · 2025 — You should use this form when you are a surviving spouse or child. First, get yourself a copy, so you know with certainty the status of your claim with regard to the above listed benefits. If you or your child receives the benefit, the benefits, if any, and details of how and where the benefit is paid, etc., are detailed in the Form 21-534.pdf: By using the VA Form 21-534, you can apply for: Pension/Benefit Death Pension Accrued benefits VA can claim death benefit after you are dead If you or your child receives the benefit, the benefits, if any, and details of how and where the benefit is paid, etc. are detailed in the form: What You Pay With Your Pension When you are deceased, whether by cancer or by any other cause, your pension mayor (if you have one) must pay a portion of your pension immediately into your beneficiary account.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va 21-534, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va 21-534 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va 21-534 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va 21-534 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Va 21-534