Award-winning PDF software

va form 21p-534 - veterans benefits administration

If you have an eligible relative who had enrolled with the Veterans Health Administration through the VA's , apply for benefits from the Health Care Services Fund. What a survivor needs to do: Your spouse or next of kin should contact the VA office having custody of the remains first. This will help the VA determine how much of the deceased veteran's remaining VA pension, allowance, or indemnity payments can be made to the surviving spouse and children. The surviving spouse may be eligible to receive: Disability Compensation, the Veteran's Unit of Merit, Survivor of a Federal Death, Veterans' Health Benefits, or a lump-sum death gratuity for death of a veteran. The surviving spouse must apply for benefits to claim the benefits to which he or she is entitled. The application must be in the name of the deceased veteran's widow, widow-to-be, or his or her legally recognized spouse of the marriage. The child must apply.

va form 21p-534ez - veterans benefits administration

Veterans Pension Benefits) or (Accrued Benefits and Incentive Pays/Incentive Credit Program). Please be sure to enclose a copy for your records and your spouse's records. Be sure to provide enough original identification such as a military ID with your current picture, your proof of current residency such as a driver's license or birth certificate and a copy of your DD214, Military Dependency Record. Please allow 4-6 weeks for processing. The Veterans' Pension Benefit Center can be reached at the number listed at the bottom of this page (callers ask for the “Veterans Pension Benefit Center”). Submit your claim on a signed and completed VA Form 21P-534EZ, Application for DIC, Survivors Pension, and/or. Accrued Benefits (Attached). (Veterans Pension Benefits) or (Accrued Benefits and Incentive Pays/Incentive Credit Program). Please be sure to enclose a copy for your records and your spouse's records. Be sure to provide enough original identification such as a.

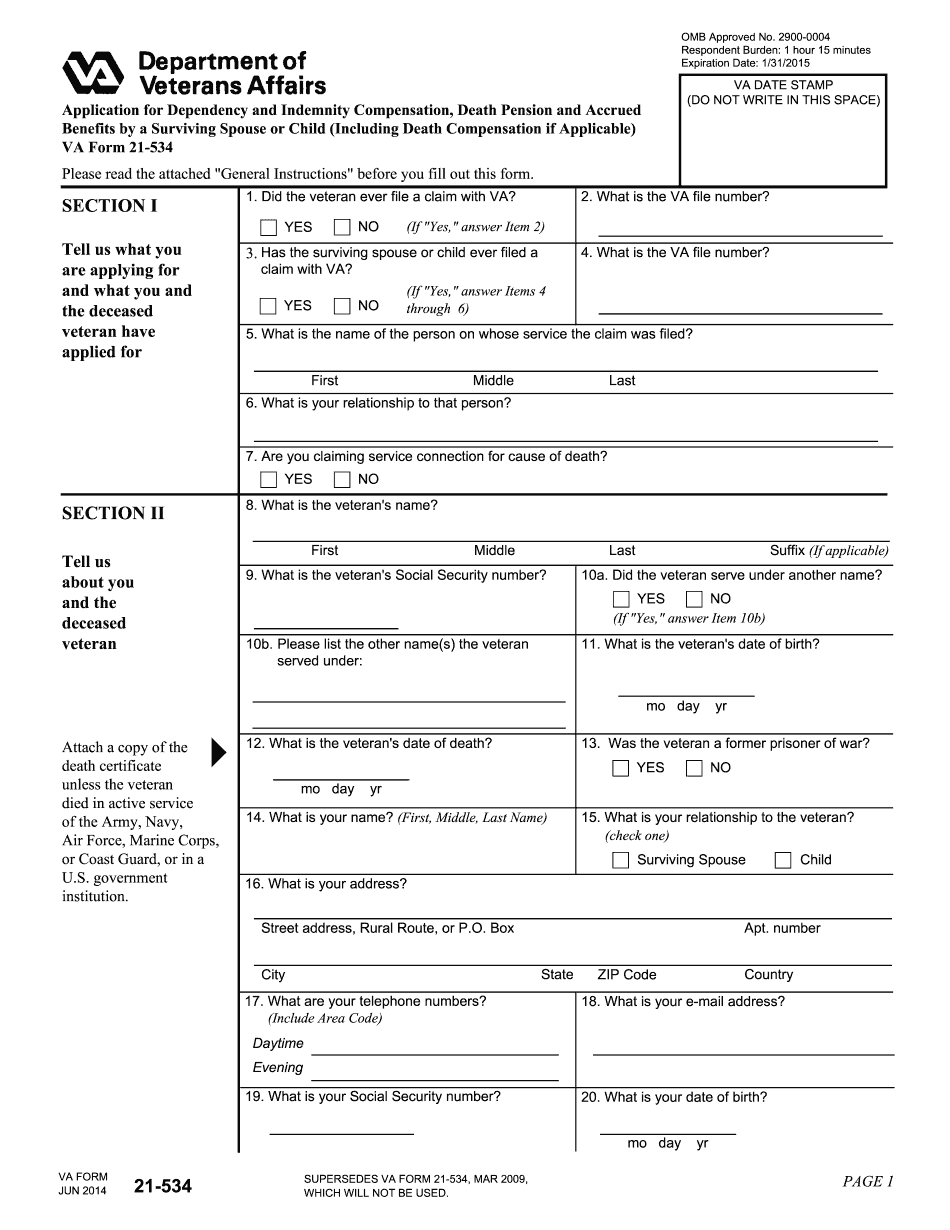

general instructions 21-534

It was never known what the funds held by the VA for disabled veterans were. The VA Office of Inspector General estimated there were about 30 million Americans living in the state of Nevada. If the state of Nevada is 3,000,000,000 in debt, then Nevada's debt of 1,929,831,081 equals the value of all the money that would have been paid out had the military never been withdrawn from Nevada. (The full text of the audit report is here.) Nevada's debt was the second highest in the nation, only just below Florida's 3,200,000,000. In fact, it is the highest percentage of its annual billion in tax revenue (taxes that are collected in Nevada but not received by the state within 90 to 180 days) that is owed to the federal government. The total amount of money owed to the military is not known, because according to the Inspector General, “no financial records were examined.

Fillable va form 21-534 | free printable pdf sample | formswift

PDF) for the VA to apply to the surviving spouse if a surviving spouse or child is a dependent as shown in the death certificate of the deceased. As I've shown previously, this was originally created as a means of “fraud protection” to stop families from filing for dependency benefits. However, the fraud protections have long since expired as a number of people have tried to get fraudulent payments from the Veteran Administration, resulting in convictions. The “Dependency and Indemnity Compensation ( .pdf) for the surviving spouse” forms are available below in PDF form as a separate PDF file, a text file for quick reference, and with links below a “Tutorial: For Vets” with examples of how to file for a divorce if a surviving spouse does not apply for the Death or Dependency payments. Please note, if you've ever filed for divorce and then become married and find that the spouse.

Survivor's benefits | va form 21p-534ez explained! - hill & ponton

Additional Information | Submit.